Today new technologies are constantly reshaping how we manage our money. One such innovation that has garnered attention is UPI Lite, Now Question is What is UPI Lite, Is it Safe or not?

In Simple Words “UPI Without PIN is UPI Lite“, UPI Lite is a user-friendly evolution of the well-known Unified Payments Interface (UPI). Let’s dive into the basics of UPI Lite, understand its operational mechanics, and highlight the key differences that set it apart from the traditional UPI.

Table of Contents

What is UPI Lite

UPI Lite is an ‘on-device’ wallet of UPI Launched by NPCI in 2022. UPI Lite is essentially a streamlined version of the existing UPI system. In UPI Lite users can add up to ₹2000 Twice a day. It allows UPI Users to Send up to ₹500 (Previously ₹200) with one click without entering the UPI PIN.

The core purpose of UPI Lite remains the same—to enable swift and secure digital transactions—but it achieves this with a simpler approach. While the UPI boasts an array of features, UPI Lite focuses on delivering a hassle-free and expedited user experience.

How UPI Lite Works

Click here to learn more

Activation:

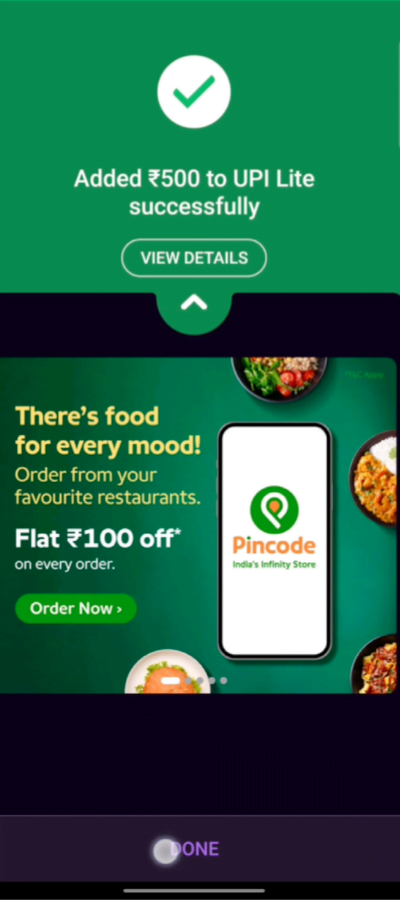

Click On the UPI Lite

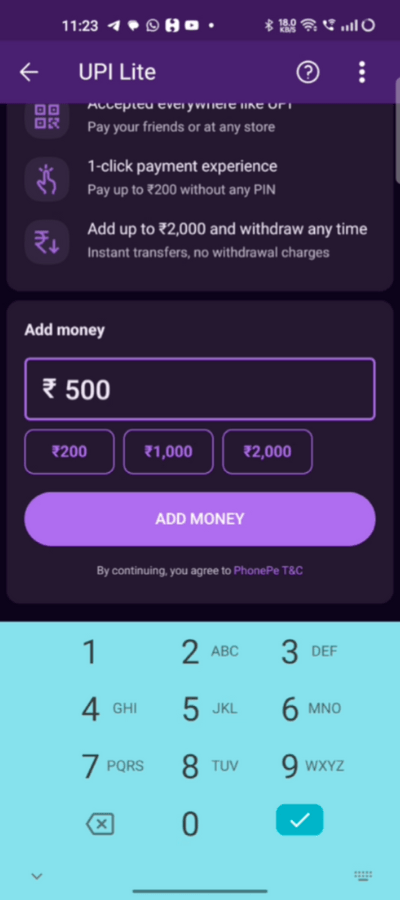

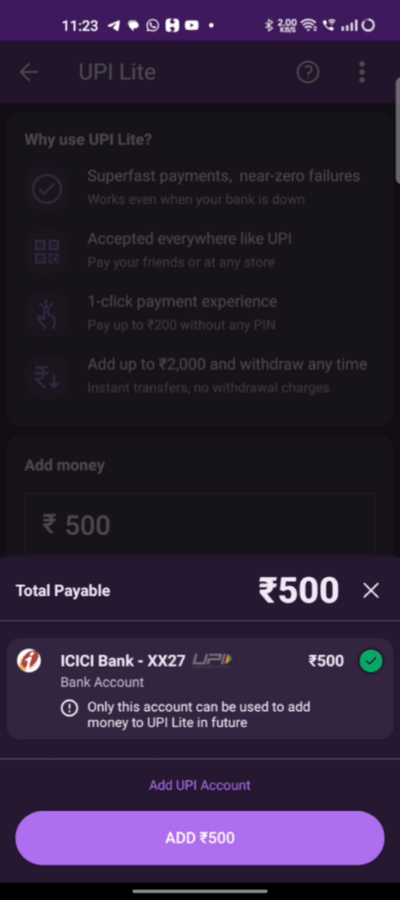

Accepts The Terms & Conditions, Add Money to UPI Lite

Enter the UPI PIN

UPI Lite is Activated

Amount Will Show in UPI Lite

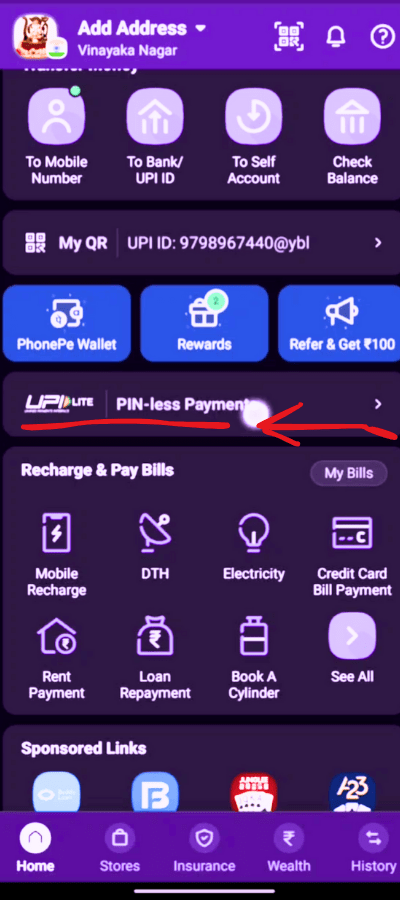

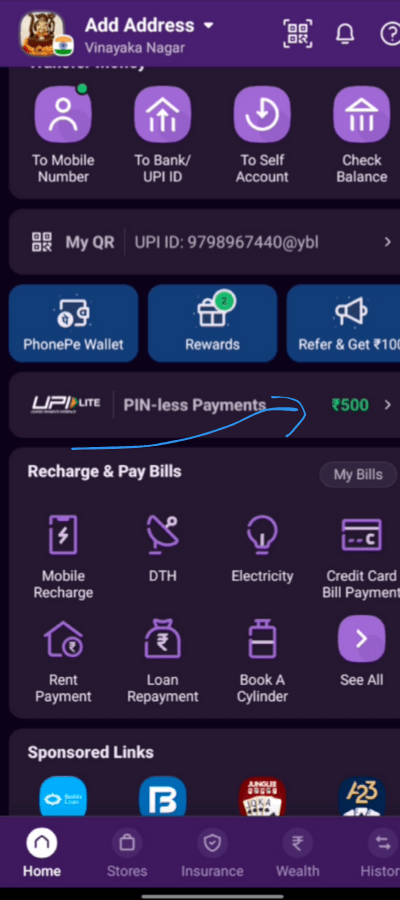

Here is an example of PhonePe App

Just Open Your UPI App

Click On the UPI Lite Enable Option available on The Home Screen

Accepts The Terms and Conditions

Add Money to UPI Lite through UPI Added Account, You can Add up to ₹2000 Twice a Day via your UPI Account.

Enter the UPI PIN

Congrats, UPI Lite is Activated

Start Transactions:

Opens the UPI App

Select Payee to Pay

Enter the amount

Money Transfer instantly to Payee Without UPI PIN

This simplicity ensures that even individuals who are new to digital payments can navigate the process effortlessly.

Utility Payments:

UPI Lite goes beyond person-to-person transfers.

It allows you to pay your utility bills, such as electricity and water bills, directly through the app.

In One Click Money will be credited to Recipient’s Account instantly.

Merchant Transactions:

For businesses, UPI Lite offers a seamless way to collect payments.

Merchants can receive Money via QR codes linked to their UPI accounts, making the checkout process smooth and cashless.

UPI Lite Bank and Apps

Here are the lists of UPI Lite Enabled Banks and Apps:

UPI Lite Banks

These are the Banks That support UPI Lite, The Number of Banks is increasing Every month

- Axis Bank Ltd

- Canara Bank

- Central Bank Of India

- Federal Bank

- HDFC Bank Ltd

- ICICI Bank

- Indian Bank

- Punjab and Sind Bank

- Punjab National Bank

- State Bank Of India

- UCO Bank

- Union Bank of India

- AU Small Finance Bank

- Kotak Mahindra Bank

- Paytm Payments Bank

- Utkarsh Small Finance Bank Ltd

UPI Lite App

In the beginning, Only these UPI Apps are live with UPI Lite:

- BHIM

- Google Pay

- Paytm

- PhonePe

*Source NPCI

Benefits of UPI Lite

Making UPI Transactions More Successful

Work With Existing UPI Apps, No Need To Download Any Separate App

Reducing the Workload on Banking System

The cost of settling transactions is expected to go down

Giving Users a Neat and Clear Passbook

Adding One-Click Security for UPI Transactions Worth Less Than ₹500

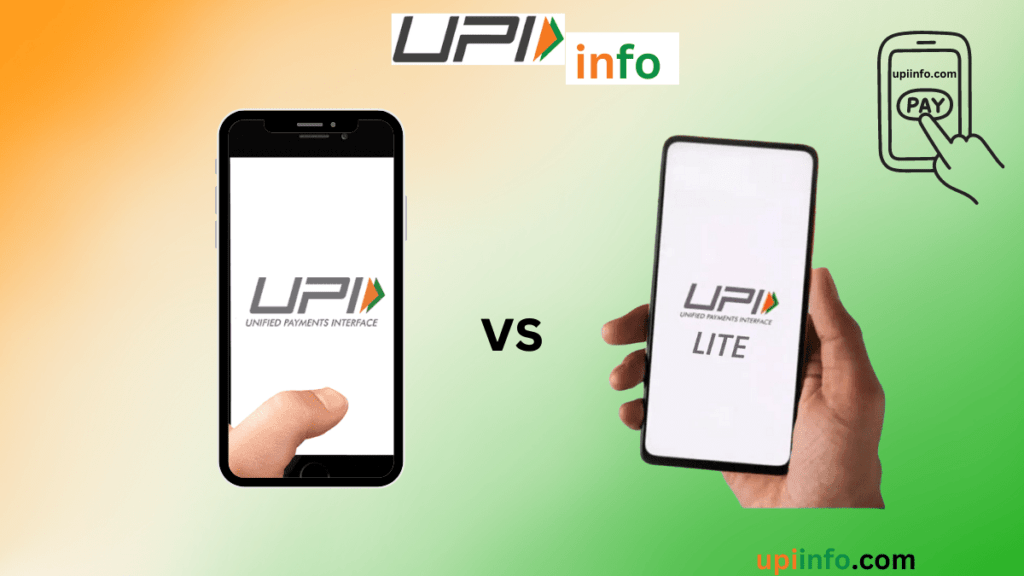

Differences between UPI Lite and UPI

UPI Lite

UPI Lite focuses primarily on quick transfers and bill payments.

PIN Less Transactions

Maximum Rs 4000 can be transferred in 1 Day, with no limit on the number of Transaction per Day but a maximum of Rs500 per transaction

Money only Sent, no receiving Option till now.

Supported By 16 Banks and 4 UPI Apps.

Used in Existing UPI Apps, no Separate Apps.

UPI

UPI offers a wide range of features

A PIN is Required for Transactions.

Maximum Rs. 200000 Can be transferred in 1 Day (Depending on the Bank), a total of 20 transactions Per Day.

Money can be Sent or Received through UPI.

Supported By Approx. 300+ Banks and All UPI Apps.

Separate Apps for UPI.

Conclusion:

In a world where time is of the essence and simplicity is valued, UPI Lite emerges as a noteworthy contender. Its focus on quick transfers, uncomplicated processes, and enhanced security make it an attractive option for a wide range of users. While traditional UPI caters to diverse needs, UPI Lite caters to those who seek efficiency without compromising on safety. As the landscape of digital finance continues to evolve, UPI Lite’s emergence signifies a step toward faster, simpler, and more secure transactions.

UPI Lite FAQs

What is UPI Lite?

UPI Lite is an ‘on-device’ wallet of UPI Launched by NPCI in 2022. UPI Lite is essentially a streamlined version of the existing UPI system. In UPI Lite users can add up to ₹2000 Twice a day. It allows UPI Users to Send up to ₹500 with one click without entering the UPI PIN.

How do I register for UPI Lite?

You just need to Activate the UPI Lite in your UPI App by Clicking the UPI Lite Link, by sending an OTP message UPI Lite will be Verified. Add money to your UPI Lite Account up to Rs. 2000

Is UPI Lite safe to use?

Yes, UPI Lite is very Safe and Simple to use. UPI Lite has the advanced safety features of UPI Which ensure secure transactions. As You Know UPI payments are regulated by the Reserve Bank of India & NPCI (National Payments Corporation of India)

Can I pay my utility bills using UPI Lite?

Yes You Can, UPI Lite allows you to conveniently pay utility bills directly through the app, It is specially designed for it.

What sets UPI Lite apart from traditional UPI?

UPI Lite focuses on simplicity, quick transfers, and bill payments, while traditional UPI offers a broader range of financial functionalities.

Pingback: What Is UPI Lite X: Offline Payment By UPI Lite X • UPI Info