NPCI (National Payments Corporation of India) is a not-for-profit organization that operates as the nodal body for retail payment systems in India. It was established in 2008 under the guidance of the Reserve Bank of India (RBI) and the Indian Banks’ Association (IBA). NPCI was created to encourage electronic payments and facilitate the adoption of digital transactions across the country.

Table of Contents

History of NPCI (National Payments Corporation of India)

2008: NPCI was incorporated in December 2008.

NPCI was established in 2008 as a not-for-profit company under Section 25 of the Companies Act, of 1956. It was promoted by the Reserve Bank of India (RBI) and the Indian Banks’ Association (IBA) with the vision to consolidate and integrate various retail payment systems in the country.

2009: NPCI launched the National Financial Switch (NFS) to facilitate ATM transactions.

2010: The Immediate Payment Service (IMPS) was introduced to enable instant interbank electronic funds transfer.

2016: The Unified Payments Interface (UPI) was launched, providing a breakthrough in simplifying mobile-based payments.

2018: NPCI launched the Bharat Bill Payment System (BBPS) to streamline and standardize bill payments.

NPCI’s history is marked by a series of innovations and initiatives aimed at transforming India’s payments landscape, fostering financial inclusion, and promoting a digital payments ecosystem. It has played a pivotal role in the increased adoption of electronic payments in the country. Please note that developments may have occurred after my last update in January 2022.

Overview of NPCI

The National Payments Corporation of India (NPCI) has played a crucial role in transforming the digital payments landscape in India. Here is a brief overview of the journey of NPCI:

Objective:

NPCI’s primary objective is to provide a robust and efficient payment infrastructure that supports various payment modes, including digital and electronic payments.

Not-for-Profit Structure:

NPCI operates on a not-for-profit basis, which means that its focus is on promoting digital payments and enhancing financial inclusion rather than maximizing profits.

Ownership:

NPCI is owned by a consortium of major banks in India, including public and private sector banks. This collaborative ownership structure ensures the participation of various stakeholders in the development and promotion of digital payment systems.

NPCI Retail Payment Systems

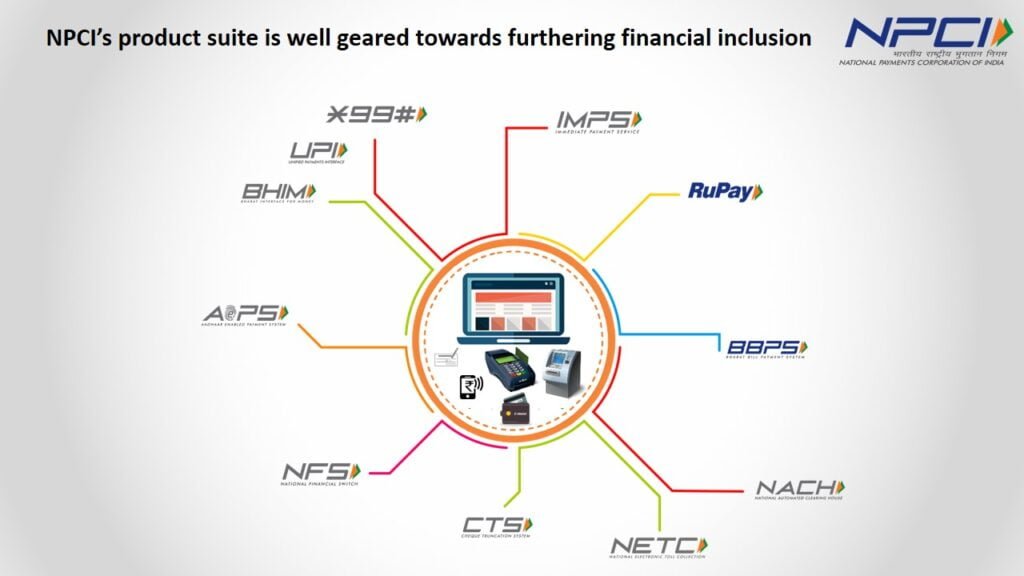

NPCI has developed and manages several retail payment systems, including:

Immediate Payment Service (IMPS)

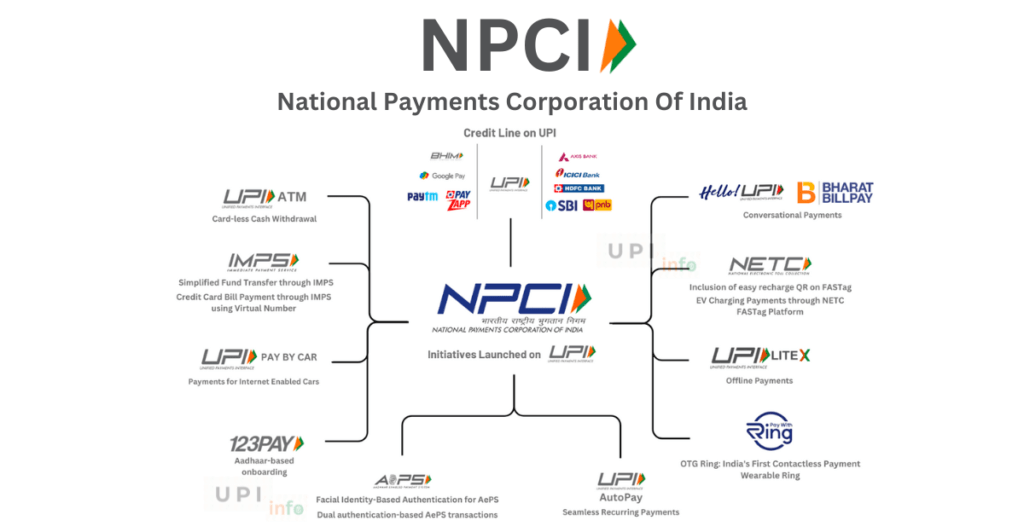

One of the early milestones for NPCI was the launch of the Immediate Payment Service (IMPS) in 2010. IMPS allowed users to make instant interbank electronic funds transfers through mobile phones, the Internet, and ATMs.

National Financial Switch (NFS)

NPCI also launched the National Financial Switch (NFS) in 2009, which is a flagship product facilitating electronic payment services across the country. It is the largest network of shared Automated Teller Machines (ATMs) in India.

Unified Payments Interface (UPI)

One of the most significant contributions of NPCI to the Indian digital payments ecosystem is the introduction of the Unified Payments Interface (UPI) in April 2016. UPI revolutionized digital payments by allowing users to link multiple bank accounts to a single mobile application and make seamless fund routing and merchant payments.

Bharat Interface for Money (BHIM)

NPCI launched the BHIM app in 2016, which is a UPI-based mobile application that enables secure, fast, and reliable cashless payments.

Bharat Bill Payment System (BBPS)

Bharat Bill Payment System is a one-stop bill payment solution for all recurring payments. BBPS is an integrated bill payment system that allows consumers to pay their bills securely.

RuPay Card

NPCI has played a pivotal role in the promotion of RuPay, a domestic card payment network that competes with international card schemes. RuPay cards were introduced to reduce the dependency on international card networks. RuPay credit card is the only card that can used in UPI for transactions.

National Automated Clearing House (NACH)

NPCI launched the National Automated Clearing House (NACH) in 2010, which facilitates high-volume, low-value electronic transactions that are repetitive and periodic in nature.

Aadhaar Enabled Payment System (AEPS)

NPCI introduced the Aadhaar Enabled Payment System (AEPS), allowing customers to carry out financial transactions on a micro-ATM using their Aadhaar number and fingerprint authentication.

Fastag

NPCI launched the National Electronic Toll Collection (NETC) program in 2014, introducing Fastag, an electronic toll collection system that uses RFID technology to make toll payments seamlessly.

International Collaborations

NPCI has also been involved in international collaborations, exploring opportunities to export its products and services to other countries.

NPCI’s journey reflects its commitment to driving financial inclusion, promoting digital transactions, and enhancing the efficiency and security of payment systems in India. The organization continues to evolve and innovate to meet the dynamic needs of the digital economy.

NPCI International Payments Limited (NIPL)

NIPL is a subsidiary of NPCI created by NPCI to take its products to the international market. Its primary focus is to help other countries in improving their Payment Ecosystem. NIPL is getting offers from many countries to join the UPI payment system and RuPay Card.

UPI is working in Bhutan, Nepal, Sri Lanka, Malaysia, France, Singapore, Australia, Canada, Hong Kong, Oman, Qatar, USA, Saudi Arabia, UAE, and the UK. It shows how unique and secure the payment system is, the rise of NIPL will increase the value of India in the International market.

FAQs

What is NPCI?

NPCI is an initiative of the Reserve Bank of India (RBI) and the Indian Banks’ Association (IBA) for operating retail payments and settlement systems in India.

What is NPCI full form?

NPCI’s full form is National Payments Corporation of India, established in 2008 by RBI(Reserve Bank of India) and IBA(Indian Bank’s Association).

Who Developed UPI?

UPI was developed by NPCI, It is a real-time, inter-bank electronic fund transfer service.

What is NIPL?

NIPL is a subsidiary of NPCI to take its products to the International market. It takes care of the International Market and helps other countries develop their Payment infrastructure.