Today UPI (Unified Payments Interface) has changed how we deal with money matters. Imagine buying things online or splitting a bill with friends – UPI turns money transfers into a breeze. Now the questions are What is UPI id, How to create UPI id, and Is It easy to use with the best safety features? It helps in the Safe Transfer of Money between Accounts.

UPI Id is the Key to secure Money transfers because of its Uniqueness for everyone, It helps in Preventing your data.

Table of Contents

What is UPI ID?

UPI ID is a special address for your money online, it is also called a Virtual Payment Address (VPA). It is like a secret code that you use to send or receive money.

This way, you don’t have to share your bank details all the time, which keeps things safe and simple. It is unique for Everyone like your Mobile Number.

It is the most important part of the UPI system, It initiates UPI transactions

What is VPA?

UPI ID is also called VPA.

VPA full form is a Virtual Payment Address

VPA is unique to every user like your email ID

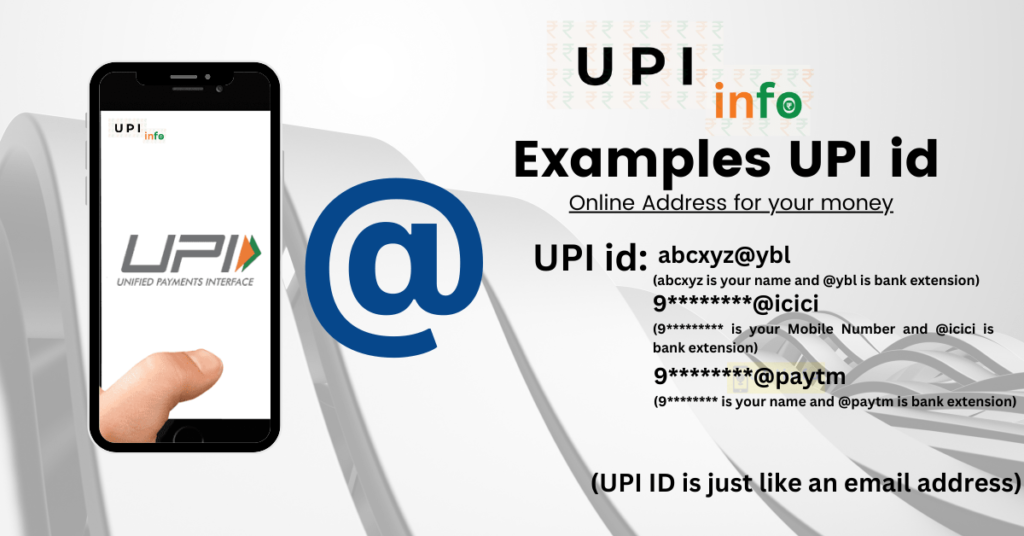

Examples of UPI ID

Here are some examples of UPI IDs:-

abcxyz@icici (abcxyz is your name and @icici is the bank extension)

9*********@ybl (9********* is your Mobile Number and @ybl is bank extension)

abcxyz@paytm (abcxyz is your name and @paytm is the bank extension)

(UPI ID is just like an email address)

How to Create UPI ID

Getting your UPI ID is easy, and you can do it in a few steps:

1. Get the App

First, get a UPI app from your app store. You will find these apps for different banks.

Once App will be downloaded It will register Your Mobile device ID with your Mobile Number and the app ID, It turns your Device into a Trusted Device for Transactions (Mobile Device ID + Mobile Number +App ID). It is called Device Binding.

2. Connect Your Bank

After you have the app, link it to your bank account from the bank list. This helps you move money between your account and the app.

3. Create Your UPI ID

Create a unique UPI ID that you’ll remember. Something like “yourname@bankname”, or “yournumber@Appextension” works well.

4. Verification

The app will ask you to confirm your Bank Account using a Text Message, To verify your transactions

UPI Best Payment System in 2023

How to Link Your Bank with UPI

Connecting your bank account to UPI is important for smooth transactions. Here’s how you do it:

1. Open the UPI App

Launch the UPI app on your phone and select the preferred language, look for the UPI section.

2. Add Your Bank

Choose the “Add Bank Account” option and pick your bank from the list.

3. Verify Your Account

The app will use your mobile number to make sure your account is really yours.

4. Set Your UPI PIN

Create a secret PIN that you’ll use when you want to send money. This keeps your transactions safe.

Send Money with UPI ID

Using UPI/VPA to send money is super simple. Follow these steps:

1. Open the UPI App

Open the app and select the preferred Language in the UPI Language section.

2. Choose Who to Send Money To

Pick the person’s UPI ID or Registered Mobile from your contacts.

3. Enter How Much

Enter the amount you want to send.

4. Confirm

Enter your secret UPI PIN to finish the transfer. share the Payment Receipt with the Recipients.

Uses of UPI ID

The uses of UPI have some great benefits:

Cashless

No need to Carry Cash so no fear of Money being lost or a Thief

Fast Transfers

Money moves right away with UPI, even on weekends. It is a real-time Payment Service 24×7.

No Extra Charges

Most of the time, there are no extra fees for UPI transactions.

Keep Your Information Safe

Your bank details stay private, so there is less risk of fraud.

Stay Safe with UPI

To make sure you are using UPI safely, keep these tips in mind:

Keep Your PIN Private

Don’t share your UPI PIN with anyone. It is like your secret code. It is key to safe and secure transactions.

Never Share Your Phone

Never give access to your Phone to Anyone, It will keep Your Money Safe.

Check Twice

Always check Twice, you are sending money to the right person to avoid mistakes.

Update Your App

Keep your UPI app up to date. New versions usually have better security.

Fix UPI ID Issues

Got a problem? Here is how you can fix common problems:

Good Internet Connection

Make sure your internet is working well so your transactions go through smoothly.

Double-Check Details

Before you send money, check the UPI ID again to make sure it is right.

Ask for Help

If you are stuck, talk to your bank’s customer support for help.

The Future of UPI

UPI has a bright future ahead. As more people use online payments, UPI will become even more important. It has become the most Popular Payment System in the World. UPI is leading the world’s Payment system through continuous research and Development.

Click here to learn about UPI ATM- a futuristic product

In Conclusion

In today’s digital world, UPI is like a trusty friend for your money. It is the easy and safe way to handle your finances – whether you are splitting bills with friends or shopping online. Just follow these steps, and you’ll become a UPI pro in no time!

FAQ

Is UPI safe to use for money transfers?

Yes, UPI is secure for money transfers. It uses encrypted technology and requires a confidential UPI PIN for authorization. It is one of the Safest Payment Systems in the World.

Can I link multiple bank accounts to a single UPI ID?

Yes, You can link multiple bank accounts to a single UPI ID. This offers the convenience of managing different accounts under one Virtual Payment Address. It helps in making Transactions as per your wish.

Can I use a UPI ID for international money transfers?

No, UPI is primarily designed for domestic transactions within India. It might be possible in the coming future because UPI has launched Internationally.

Do UPI transactions have any extra charges?

No, not right now but you should check your Bank for a better understanding.

Pingback: UPI: Best Payment System In 2023 • UPI Info

Very informative

Pingback: 7 Best UPI Apps: Best UPI Apps For Secure Transactions